6 Easy Facts About Top 30 Forex Brokers Described

6 Easy Facts About Top 30 Forex Brokers Described

Blog Article

Rumored Buzz on Top 30 Forex Brokers

Table of ContentsFacts About Top 30 Forex Brokers Revealed7 Simple Techniques For Top 30 Forex BrokersThe Top 30 Forex Brokers DiariesEverything about Top 30 Forex BrokersSome Known Facts About Top 30 Forex Brokers.A Biased View of Top 30 Forex BrokersThe Single Strategy To Use For Top 30 Forex Brokers

Forex is the biggest and most liquid market in the world. A job as a foreign exchange trader can be lucrative, flexible, and highly engaging. There is a steep learning curve and forex investors face high dangers, utilize, and volatility.

There are a number of benefits that a career as a foreign exchange investor, likewise called a fx trader, uses. They include: Forex trading can have very inexpensive (brokerage firm and compensations). There are no compensations in a genuine sensemost forex brokers make profits from the spreads in between foreign exchange currencies. One does not have to fret regarding including different broker agent fees, getting rid of overhead costs.

The Ultimate Guide To Top 30 Forex Brokers

The forex markets run all the time, enabling professions at one's comfort, which is extremely beneficial to temporary traders that have a tendency to take positions over brief durations (claim a few minutes to a few hours). Few traders make professions during total off-hours. Australia's daytime is the nighttime for the East Shore of the U.S.

business hours, as little development is advancement and prices are costs a stable range during array throughout for AUD. Such traders adopt high-volume, low-profit trading strategies, as they have little earnings margins as a result of an absence of advancements specific to forex markets. Instead, they try to make profits on fairly stable low volatility period and compensate with high volume trades.

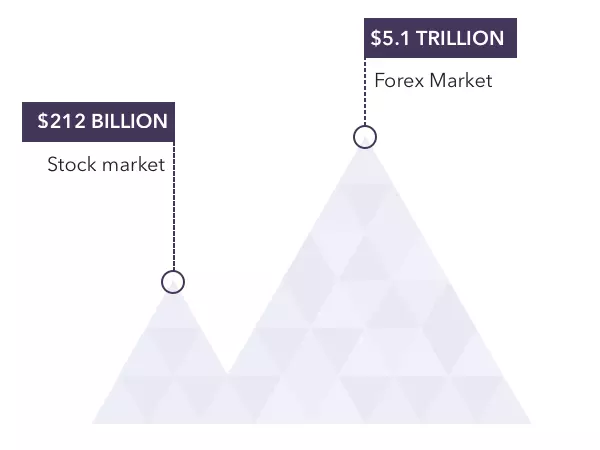

Foreign exchange trading is extremely suiting this way. Compared to any kind of various other financial market, the foreign exchange market has the biggest notional worth of everyday trading. This offers the highest degree of liquidity, which implies also big orders of money trades are quickly loaded successfully with no large cost inconsistencies. This gets rid of the possibility of price manipulation and rate abnormalities, thus making it possible for tighter spreads that result in more effective rates.

Unless significant occasions are anticipated, one can observe similar cost patterns (of high, mid, or low volatility) throughout the non-stop trading. Being an over-the-counter market operating throughout the world, there is no main exchange or regulator for the forex market. Various nations' main financial institutions sometimes intervene as required pop over to this site yet these are rare events, taking place under extreme conditions.

Top 30 Forex Brokers Fundamentals Explained

Such a decentralized and (reasonably) decontrolled market helps avoid any abrupt shocks. Contrast that to equity markets, where a business can unexpectedly state a dividend or record substantial losses, causing significant cost modifications. This low degree of regulation additionally helps keep prices low. Orders are straight placed with the broker who performs them on their own.

The significant money often show high price swings. If professions are positioned intelligently, high volatility aids in massive profit-making chances. There are 28 significant currency sets involving 8 significant currencies. Criteria for choosing a set can be practical timing, volatility patterns, or economic growths. A forex investor that loves volatility can easily switch over from one currency set to another.

Top 30 Forex Brokers - Truths

While trading on such high margins comes with its very own threats, it additionally makes it much easier to obtain much better revenue capacity with restricted funding.

Due to the large dimension of the forex market, it is less prone to expert trading than a few other markets, specifically for significant currency sets. Nonetheless, it is still sometimes based on market control. Basically, there are great deals of advantages to forex trading as an occupation, however there are negative aspects also.

Top 30 Forex Brokers Things To Know Before You Get This

Being broker-driven ways that the foreign exchange market may not be completely clear. An investor might not have any type of control over exactly how his profession order gets met, might not get the very best price, or might get limited views on trading quotes as given only by his chosen broker. A straightforward remedy is to deal only with regulated brokers who drop within the purview of broker regulators.

Foreign exchange prices are influenced by multiple elements, largely global politics or economics that can be hard to evaluate information and draw reputable verdicts to trade on. A lot of foreign exchange trading takes place on technological indicators, which is the main reason for the high volatility in foreign exchange markets. Getting the technicals wrong will certainly lead to a loss.

Top 30 Forex Brokers for Dummies

Forex investors are totally on their very own with little or no help. Disciplined and continual self-directed knowing is a must throughout the trading profession.

Report this page